Offshore Business Registration Can Be Fun For Anyone

Table of ContentsOffshore Business Registration Things To Know Before You BuyThe 8-Second Trick For Offshore Business RegistrationSee This Report on Offshore Business RegistrationThe 3-Minute Rule for Offshore Business Registration

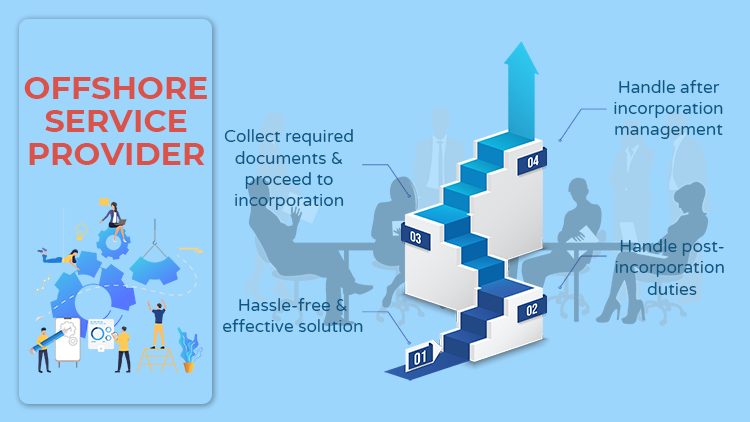

** This would certainly refer to the corporate tax of the firm, where the operation of the company would take place outside the nation of unification. *** The required files should be supplied for every private related to the business.Have an offshore business all set in an issue of days. 2 Submit Yourdocuments online 3 We register withauthorities overseas 4 Your company as well as bankaccount prepare!.

We make use of some essential cookies to make this web site job (offshore business registration). We want to establish extra cookies to understand how you use GOV.UK, remember your settings and boost government solutions. We also utilize cookies established by other sites to assist us deliver web content from their solutions.

Developing on your own offshore has actually never ever been even more popular, as several individuals are looking for alternate sources and ways to save cash, protect their personal privacy and also possessions in times of easy, uncomplicated and also can be completed in an issue of days with just a few fundamental personal information. This short article is to take you with just how to establish an overseas firm: from choice, registration, all the means to the formation procedure in order to damage the frequently held idea that a business development procedure is a troublesome affair with great deals of troubles and also pain along the road.

Offshore Business Registration - Truths

Depending on your demands there are various offshore frameworks whether that is a Trust fund, Foundation or IBC, LLC and so on. Because of the constantly changing nature of the overseas industry, specifically when it concerns overseas tax obligation legislations, it is essential to have up-to-date information, as neighborhood tax obligation regulations are increasingly changing because of global company pressures.

They are similarly vital to think about as numerous people like to keep points near house - offshore business registration. The following set of questions is likely going to take some study as tax obligation regulations are various for each country. To make sure you are tax obligation compliant it is necessary to speak with a qualified accountant or look at this now attorney to make certain you are not missing out on anything.

While DTTs can help you save money on taxes, CRS and TIEA do not. are a form of reciprocatory tax obligation information sharing that are signed in between participant nations. While there are still numerous overseas territories that are not notaries the number is quickly decreasing as increasingly more nations are being co-opted by the OCED to sign onto greater transparency procedures.

5 Simple Techniques For Offshore Business Registration

legislations regulate exactly how firms are dealt with as a tax entity. Every country has its very own particular CFC regulations click here for info which may or may not impact your business structuring. Some countries have very rigorous CFC regulations that basically deal with foreign firms as neighborhood entities for tax functions. All of the above factors to consider are very important as they will certainly influence the company framework, place and also company vehicle that would be made use of.

That is why website link it is so vital to talk with an offshore expert. Without such specialized knowledge, there is the threat of creating the incorrect entity in the wrong jurisdiction, with the wrong company structure. Developing a complete all natural offshore lawful strategy assists to make certain that every one of the pieces are arranged and also that the offshore method fits with you the goals of the company.

While that is not constantly the case, it is ending up being much more typical in areas like Singapore, Panama, and Hong Kong where there are extra limitations, higher price tags and also more due persistance. Still, there are offshore jurisdictions like St Vincent, Nevis, or Andorra that do not require a local company and can be opened up essentially without any type of in-person demands.

The Main Principles Of Offshore Business Registration

For people looking to preserve, the usage of a 2nd LLC or IBC as a corporate supervisor and also shareholder can be used to make sure that no individual's identification remains on the company windows registry. While a lot of offshore territories still have really rigorous personal privacy and banking secrecy legislations, like the Cook Islands, as well as Nevis, there are many countries like the US and many components of Europe that require individuals to state and also international ownership of a company, hence making your responsibilities to state any companies and also properties a commitment needed by the nation where you live.

Because of the change in lots of countries' openness laws foreign federal governments, if you stay in a country that is a notary of the CRS then your government will have greater access to your foreign company info. Nevertheless, these documents would just be readily available to YOUR residence government, and also would not be apart of the local public computer registry.